Businesses accepting online payments through several portals might not get affected by additional charges. However, the credit card processing fees remain expensive for making a single transaction. As a result, this exorbitant cost might hit the profit margin of a business. Automated Clearing House- ACH payment is a cheaper alternative solution that minimizes credit card processing charges.

ACH is a constructive financial network that processes money transfers & digital payments. It enables easy bank transfers between individuals, commercials, and government accounts without presenting cash, checks, and cards. In this article, we’ve uncovered the benefits of using ACH payments & working system of it using Plaid and Stripe.

Several factors must be taken into consideration while integrating a payment gateway for your business. Including cost, ease of use, technological needs, and user experience, ACH is the frontrunner in credit processing solutions. This online payment method helps you and your consumers to save time and money with more security & convenience. Here are 7-valid reasons that add more benefits to your business and improve customer satisfaction.

ACH processing can reduce the transaction costs compared to credit cards & checks. Credit card processing fees are around 2.5-3.5 percent of a transaction. However, an individual spends $4 to $20 for writing business checks (including mailing, signing, payment initiation, authorization, printing, and time spent).

On the flip side, processing fees with ACH are $1 less for each transaction. There are no set prices applicable for ACH payments like credit cards. The transaction takes place between two bank accounts using a clearing house which keeps the overhead cost low.

Whether sending or accepting funds, ACH payments offer you a dependable cash flow and more control of your fund. If a consumer uses ACH payments, their checks arrive timely as the funds get transferred directly from the respective bank accounts.

You can schedule your due payments accordingly with ACH while paying your suppliers or vendors. Additionally, employers use ACH payments to clear their taxes and direct deposit for paying their employees through the bank. It allows you to maintain your fund in your account as long as you want. Thus, it reduces uncertainties, streamlines your account payable & receivable functions, and maximizes value.

ACH makes the money transfer process simple. It takes less than five business days as a settlement time to clear a fund, which is faster than credit cards & checks. Additionally, (National Automated Clearing House Association) NACHA has approved a rule for one-day ACH transfer. NACHA operates this function through two processing windows:

Thus, it will give more flexibility, workflow efficiency, and quicker access to funds for the operating businesses.

ACH direct debit or ‘auto pay’ is the most cost-effective tool that helps business operates on the subscription model. So, there is no involvement in paying high monthly processing fees. Once a customer authorizes the ACH direct debits, you can collect recurring payments effortlessly and reliably.

ACH makes your money transfers more convenient for internet-initiated payments, direct deposits, and (P2P) Peer-to-Peer payments. It lets your customers set up a one-time or recurring payment option for paying their bills. Thus, it facilitates you to timely collect payments by generating auto-invoice. Furthermore, the chances of shopping cart abandonment rate and payment disputes are lower with ACH.

In the case of checks, there are chances of being stolen or signature forgery. ACH eliminates intermediaries as transactions take place directly between bank accounts. Some customers may hesitate to share their banking details. With ACH, payment processors perform two-way verification to validate the authenticity of both parties. Additionally, it adds an extra security layer with encryption to keep the details of customers intact and safe. This verification process ensures two crucial things: the accuracy of the account information & no transaction blocks.

Credit cards have a 3-years lifespan by considering the facts like damage, expiry, and chances of losing or misplacement. On average, an individual uses a bank account for 14 years. Establishing a link with the customer’s bank account through ACH might reduce the payment churn and increase revenue. Specifically, it is applicable for recurring payments such as software subscriptions. Even for B2B spaces, around 20-40 percent of churn generates from credit card errors. So, payment gateway integration using Plaid ACH & Stripe is profitable for businesses in the long term.

Let’s find out how to initiate ACH Payments using Plaid & Stripe.

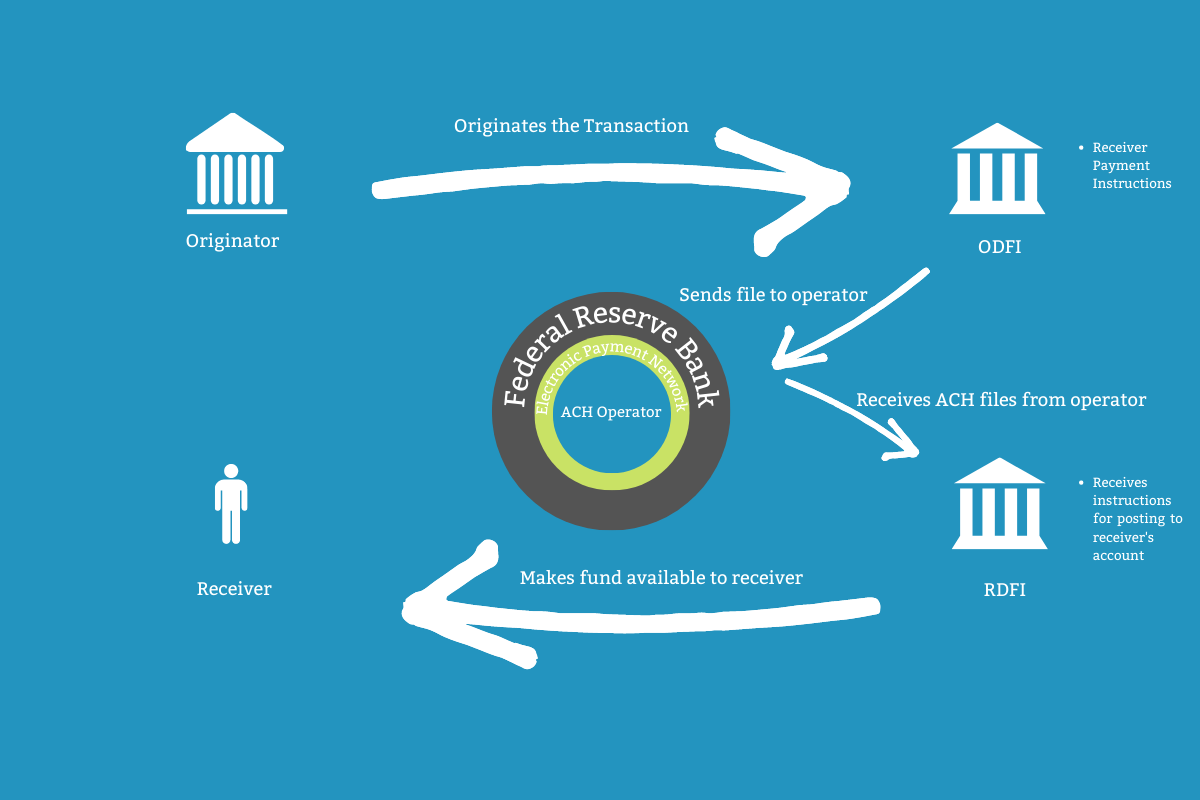

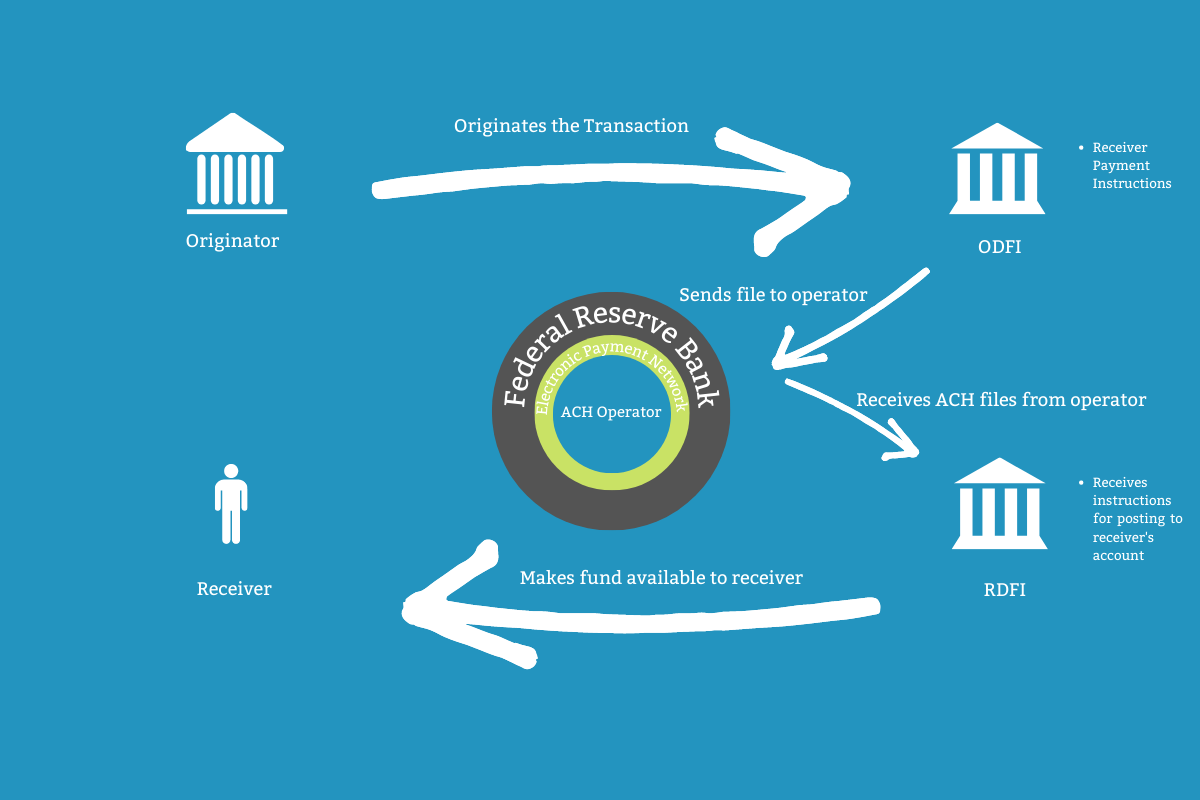

Before starting ACH transactions, you need one system that connects you with an ODFI (Originating Depository Financial Institution). The system must be able to update you with the payment status. Including that, it needs to facilitate an interface to authenticate, cross-check, and charge the user accordingly.

Here comes the presence of Stripe alongside a partnership with Plaid to make the fund transfers seamless through ACH. So, you need to understand the connectivity between the two entities. By using Plaid, the Stripe account holder can authorize the users and leave out the micro-deposit authentication process delay. So, Stripe is responsible for handling the ACH workflow and the funds’ movement. And, Plaid acts as a data provider and an authentication gateway for users to tokenize the ACH transaction.

ACH is a multi-staged and layered process that works steadily to verify & protect the data of all the parties involved. Thus, we have distributed the entire transaction process to analyze the ACH workflow and the contributions of Plaid & Stripe.

You need a software application to maintain the records of your online store. Online multi-vendor marketplace application with payment integration via ACH helps you to keep financial transaction records. So, to execute the whole function, you need to register with Stripe by providing a few details about your business, personal information, valid Social Security Number, and contact details. For Plaid, you only need to provide your name and email id to get started. However, crossing more than 100 users’ calls might need additional information.

Financial bodies work as a mediator of the ACH network. They get the ACH files from a provider and transfer them to the respective cleaning houses. ACH providers or customers may get the notification of the transaction status if the financial institution is an RFDI or OFDI. In the case of Stripe, Wells Fargo is its OFDI, and Plaid deals with the user’s bank for retrieving & validating the information to ensure the transaction is legitimate.

Plaid authenticates the buyers or users to authorize the ACH payment via Stripe. It enables you to integrate the Plaid Link module into your application. As a result, this will create a safe gateway for users to link their bank accounts by filling in all the credentials. Once the Stripe account gets connected with the Plaid, it offers a valid token for Stripe to continue the ACH transaction.

Stripe allows you to charge ACH payments to consumers. To perform that function, the application developer or owner needs to create a Customer item within the internal system of Stripe. It requires an authorized token issued by Plaid. Furthermore, the developer can charge the customer by placing a Charge item in the database. This action will trigger Stripe to generate an ACH file for proceeding to its OFDI. Stripe also offers endpoints & webhooks to the developers for getting updates.

Customers or buyers are unaware of this entire backend or web development procedure that happens while purchasing a product from an online store. To validate the transactions, the user needs to provide a few banking credentials through the secure Plaid module. After the completion of the transaction, the user can check the pending transfer in the respective bank account, product delivery status, and the final settled transaction.

With the increase in digital payment methods, businesses & customers seek better alternatives. So, ACH payment is the most cost-effective way that gives significant savings over credit & debit card fees. Now, any business can use these technologies and set up their payment gateway integration option to save more on billings.

So, Capsquery has simplified all the technical aspects of ACH payment processing with Plaid & Stripe. Thus, switching your payment method to ACH might enhance your user experience & economize your financial transactions. For more details regarding the payment integration API functions, hit the comment box or contact us.

Website Development | Mobile App Development | Application Development

We will definitely get back in touch with you over mail within 12 Hours.

In-case you have not heard from us within 12 hours, kindly check your spam once.

I'm a software consultant. I've 7+ years of industry experience. I'd love to connect with you and brainstorm your custom software needs. It's my responsibility to find you the best solution.

ANAND GUPTA

Drop your details and we'll get in touch with you within 12 hours.

Reach us for

Talk to us