From grocery shopping to buying medicines, customers prefer digital payment methods for easy checkout. For an e-commerce store, integrating an online payment system helps you expand your business transactions and enhance user experience. Cashless payments have become more prevalent in the modern B2C (business to consumer) or B2B (business to business) service landscape. Hence, introducing electronic payments improves your business’s daily operations, customer retention value, and cash flow management.

With so many available options, choosing the right payment processor is crucial for a business entity to provide a better and more secure online shopping environment. You can use direct bank transfers, external payment gateways, a custom WordPress payment plugin, and other means based on your business needs. Let’s check the best ways to implement a digital payment system and its importance for eCommerce websites.

Some eCommerce platforms provide built-in digital payment systems that may have several restrictions. Therefore, integrating a payment gateway plugin expands sales capabilities and simplifies online transactions of your default eCommerce website. A payment gateway plugin acts as a connector that links your business site to a 3rd-party payment gateway vendor like Stripe, PayPal, and more via API.

Whether you use a custom-coded platform, CMS (WordPress, Magento, Drupal, etc.), or other eCommerce software, WooCommerce is one of the most powerful and best WordPress-based digital payment plugins that fulfil all your eCommerce needs. It’s a one-stop solution that sells both physical and digital products and works smoothly with all payment gateways. In this blog, we will share the technical steps of setting up a WordPress payment gateway using the WooCommerce plugin.

You need to navigate your WordPress dashboard, click the ‘Plugins’ menu, hit the ‘Add New’ option, and search ‘WooCommerce’. Install the plugin and select ‘Active’.

Once you activate the plugin, the next step is to configure the WooCommerce plugin through a setup wizard. In this section, you can add important details about your eComm store, product units, shipping, tax details, and other information.

After finalizing the plugin setup process, select your preferred payment method or gateway, such as Stripe, PayPal, Authorize.Net, and more. Here are a few more steps to integrate a payment gateway using WooCommerce into your WordPress or other eCommerce platforms:

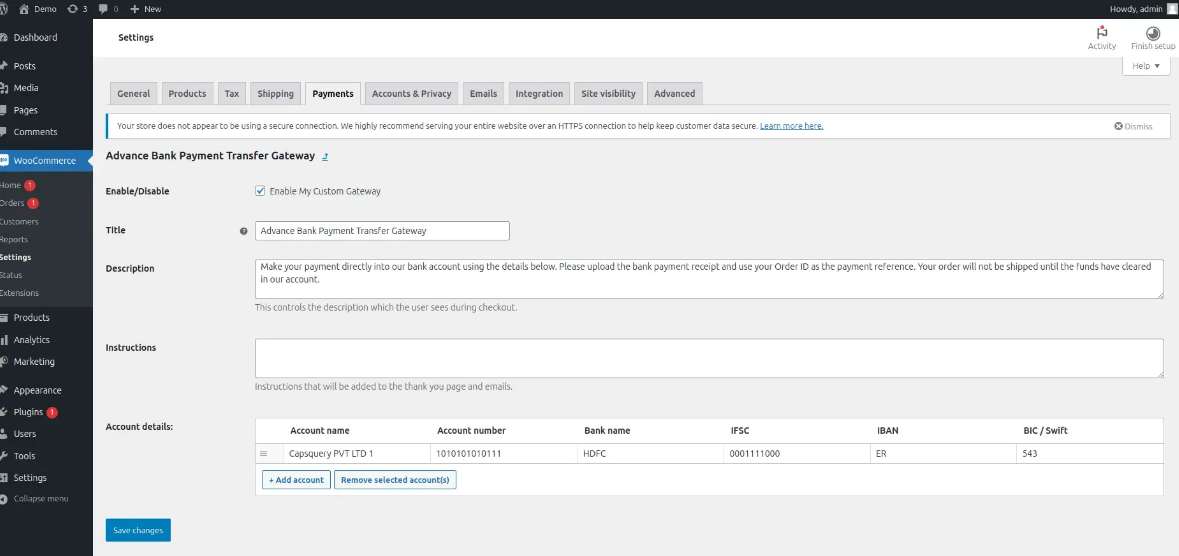

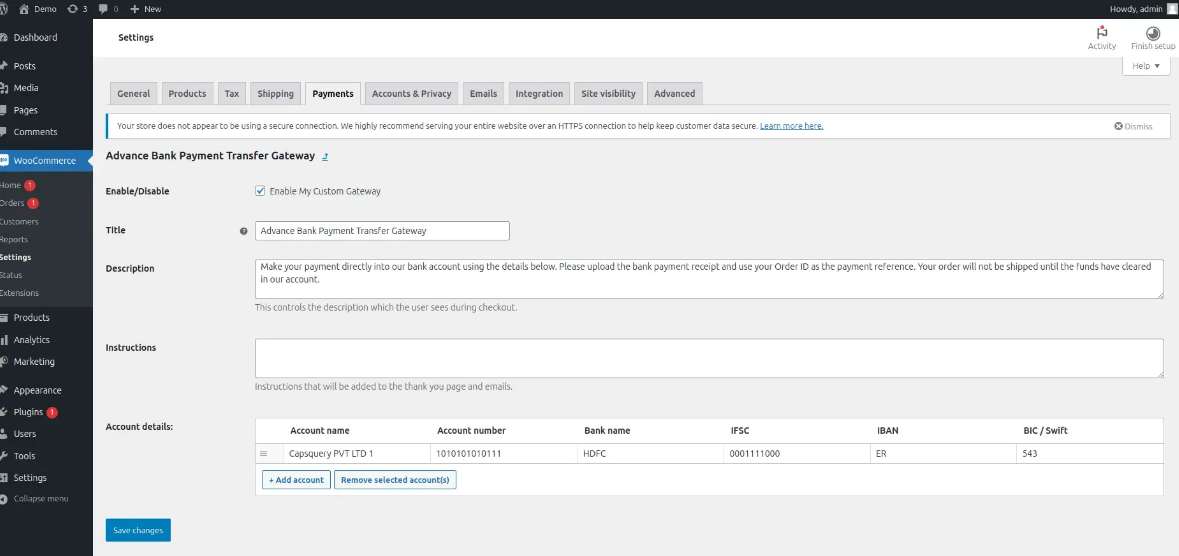

Here’s an example of Advance Bank Payment Transfer Gateway which is published in the WordPress Plugin Directory: (https://wordpress.org/plugins/advance-bank-payment-transfer-gateway/). This plugin replicates the Direct Bank Transfer gateway to produce another offline payment method. It is effective for testing a payment method, generating manual invoices, and offline payment systems. Go through the Advance Bank Payment Transfer Gateway installation blog to learn more about the set-up process and use cases.

Advance Bank Payment Transfer Plugin back-end setup for web store owners

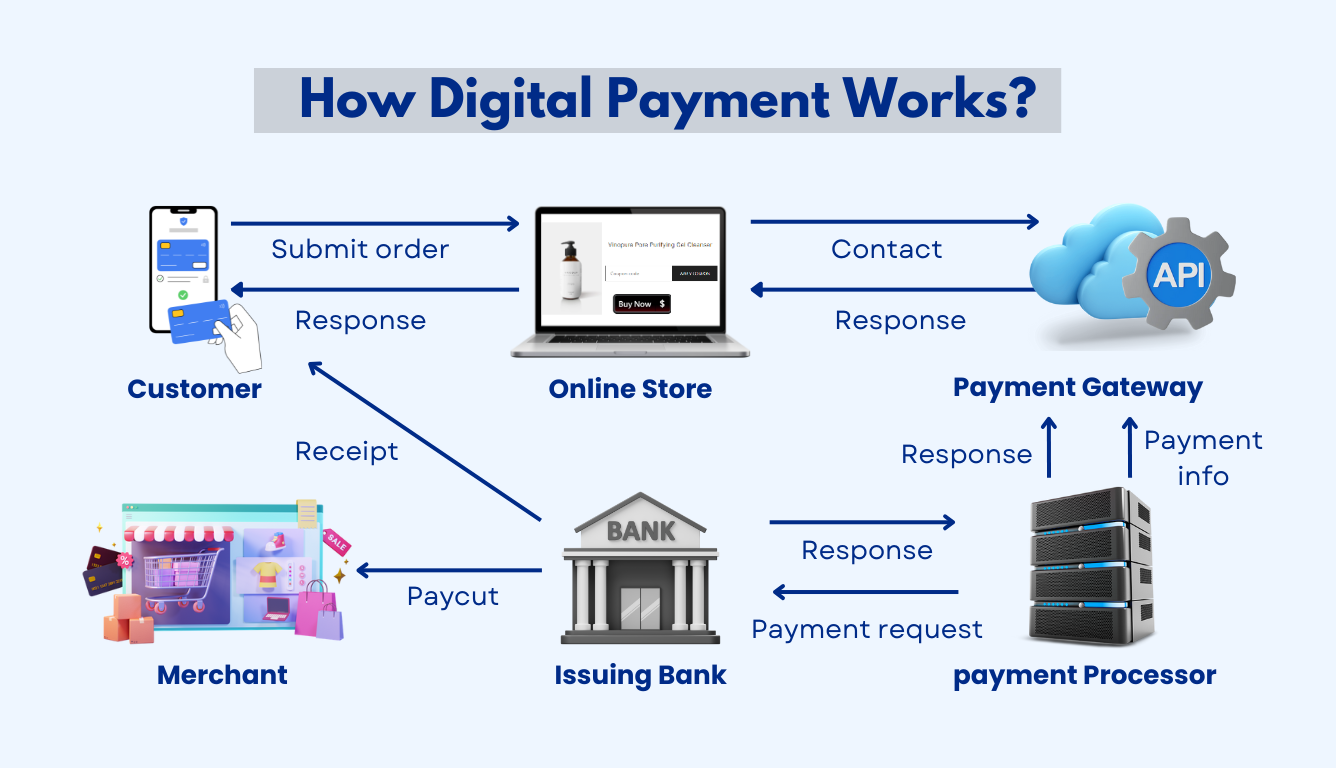

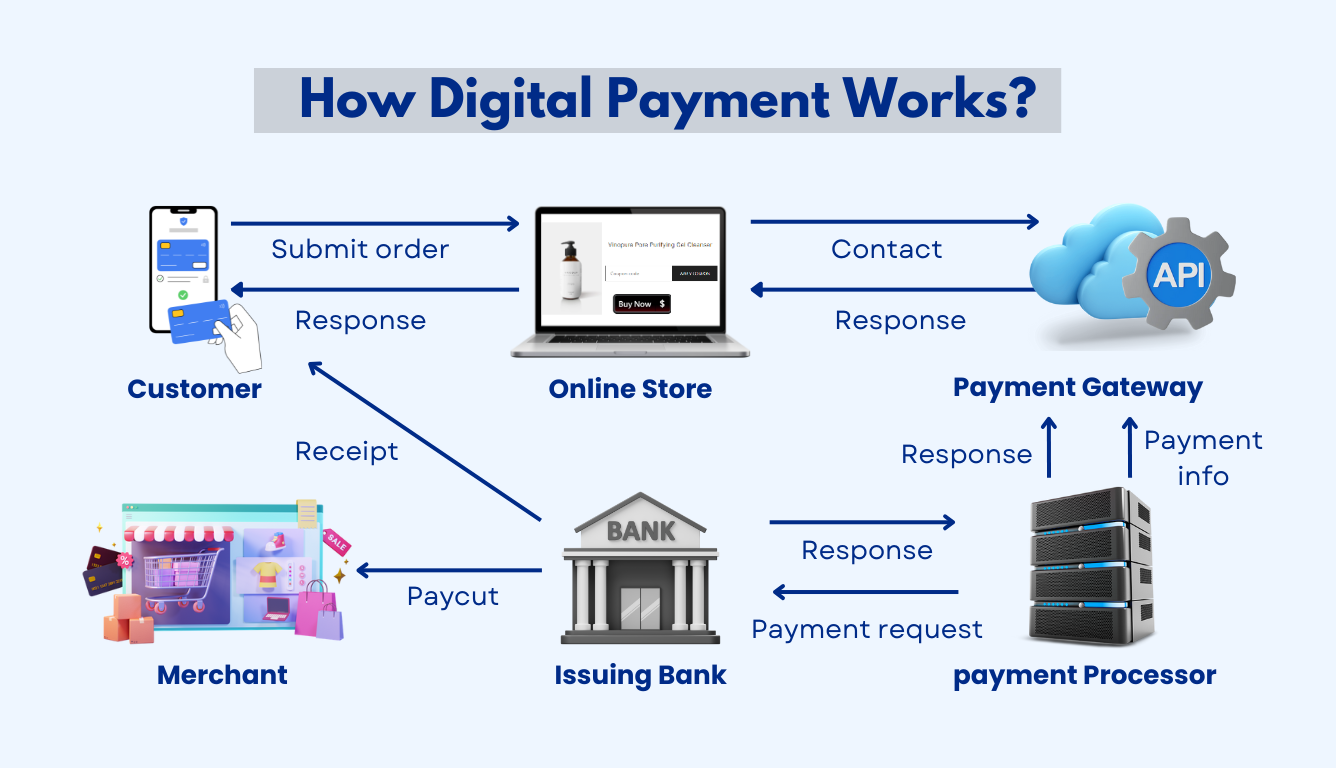

Several payment processing units and intermediaries are responsible for a successful e-payment transaction. A digital payment system works by a collective effort that connects an eCommerce storefront to a respective payment processing vendor through a payment gateway or plugin. Later, it transfers the funds from your account to the merchant’s bank account after validating the payment request. Here’s an in-depth explanation of how digital payment methods work.

All eCommerce payments don’t function similarly. Digital payment methods may work differently based on the e-commerce products & services, processing speed of the payment network, multi-currency support, geolocation availability, accepted card types, and other criteria. Here are a few common and globally accepted e-payment systems that work seamlessly for e-commerce businesses:

A digital or mobile wallet is a replica of your physical debit or credit card that you can use through a mobile device. Mobile or digital wallets securely keep your banking details with a payment processor to make a payment quickly. Examples of widely circulated digital or mobile wallets are Apple Pay, PayPal, Amazon Pay, Paytm, Walmart Pay, and more. These wallets are useful for several purposes, such as online shopping, fund transfers, merchant payments, and other transactions.

It is a convenient way of transferring funds without having a mobile app or website. A merchant can directly send a payment link to a customer through text, e-mail, QR code, social media platforms, or other communicative mediums. Some links automatically direct to the buyer’s preferred payment app or mobile wallet, where banking details are pre-filled. For example, Stripe provides payment links to sell products and services without an eCommerce shop. Some other direct payment link providers are Cashfree, PayPal, and Razorpay.

P2P payment helps you to send funds directly from one account to another using a payment gateway like Stripe, Square, PayPal, Venmo, etc. To set up a P2P payment system, you need a suitable payment gateway vendor that meets your requirements, such as multi-currency payments, transaction fees, user interface, subscriptions, and security features. It is effective for small businesses as P2P payments are comparatively less expensive than other digital payment methods.

Banks offer EFTs/NEFTs, IMPS, and RTGS as a mode of online payment that allows consumers to transfer funds from their account to a merchant account. It is also a secure process for eCommerce businesses to collect money from customers directly through the banking portal.

Crypto is another form of digital payment that works as a digital currency and virtual accounting system. It uses encrypted algorithms and Blockchain technology for data protection and secure transactions. For example, Bitcoin and Ether are the most commonly used crypto or electronic currencies that you can get through the crypto wallet.

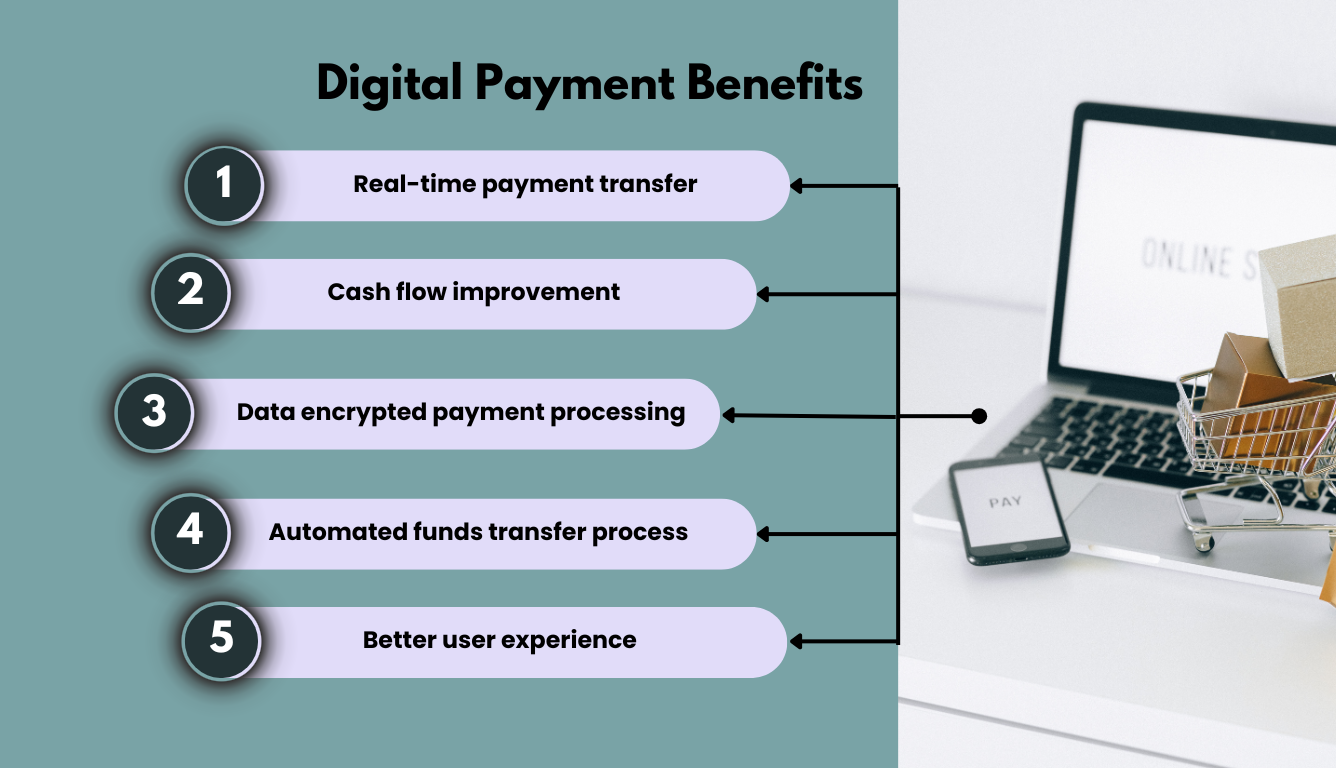

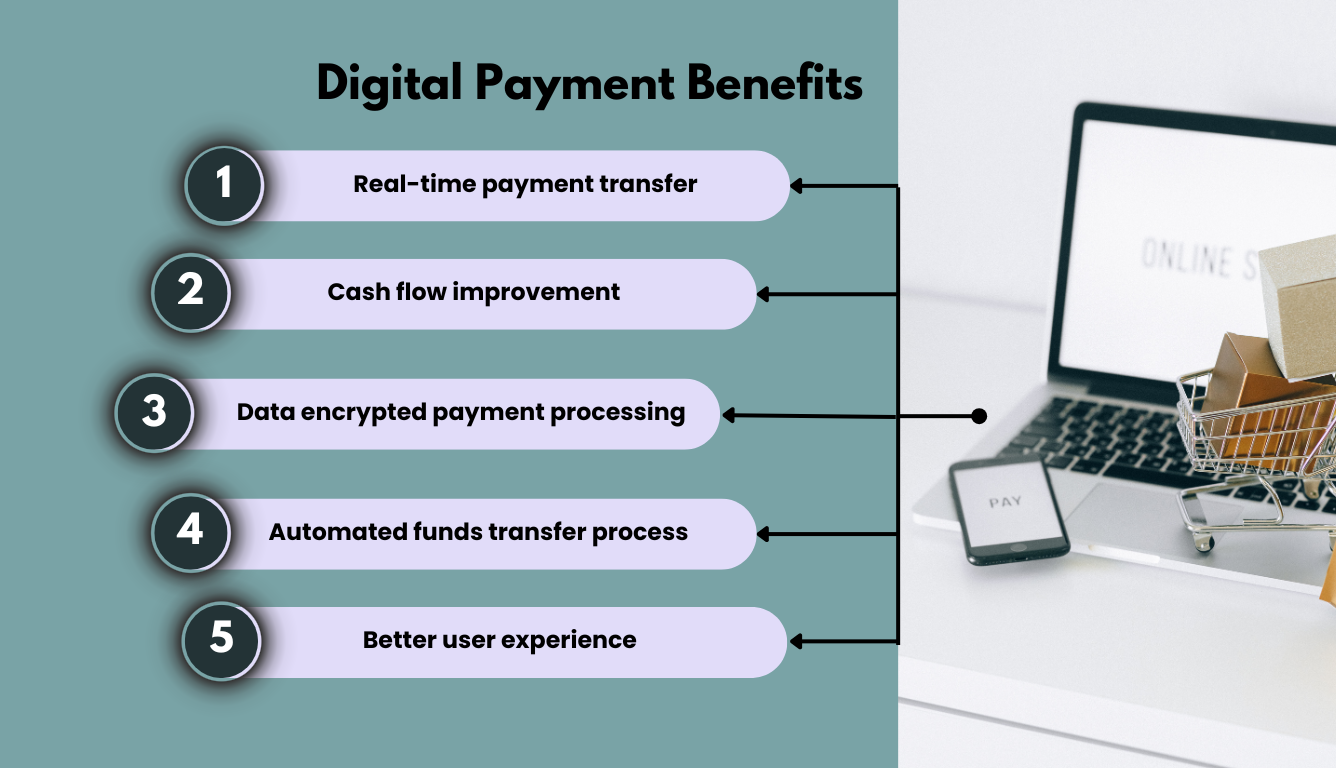

Digital payment is one of the quintessential parts of an eCommerce business. From purchasing a product to the checkout process, providing hassle-free shopping is only possible through an electronic payment system. Let’s find out the benefits of an online payment system for both customers and e-commerce businesses.

Buyers need flawless and effortless shopping destinations with quick checkouts. With online payment, it is easier and more convenient for customers to complete their transactions. Here are a few reasons why customers prefer an e-payment system more than traditional methods:

Integrating an online payment system into your eCommerce business website is also beneficial for retailers to run their business operations smoothly. Here’s how a digital payment gives uncountable benefits to an eCommerce business:

Digital payment is not just an example of technological advancement. It is an integral part of the financial ecosystem and online business activities. As a business owner, it is your responsibility to provide a secure and trouble-free shopping experience to your customers. It helps you attract new consumers and inspire your existing ones to stay with your brand. If you need to set up digital payment through the WooCommerce payment gateway plugin, drop your comments below or contact us.

Website Development | Mobile App Development | Application Development

We will definitely get back in touch with you over mail within 12 Hours.

In-case you have not heard from us within 12 hours, kindly check your spam once.

I'm a software consultant. I've 7+ years of industry experience. I'd love to connect with you and brainstorm your custom software needs. It's my responsibility to find you the best solution.

ANAND GUPTA

Drop your details and we'll get in touch with you within 12 hours.

Reach us for

Talk to us